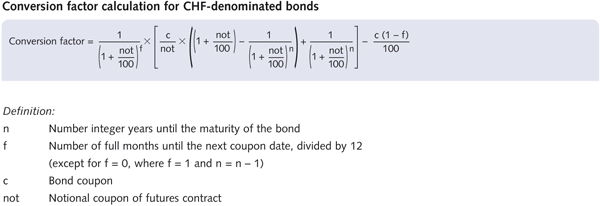

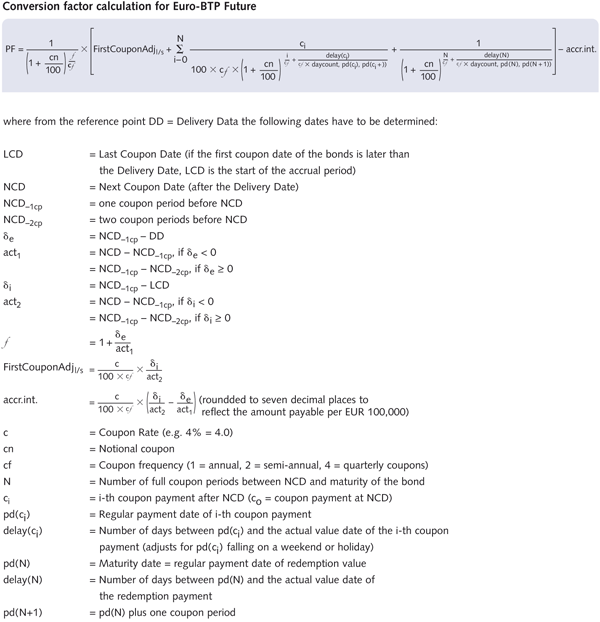

Intuition and reasoning behind conversion factor calculation for bond futures - Quantitative Finance Stack Exchange

𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 on Twitter: "So in simple terms, the implied repo rate is the implied money market return from a cash and carry trade. And for a treasury futures seller, that

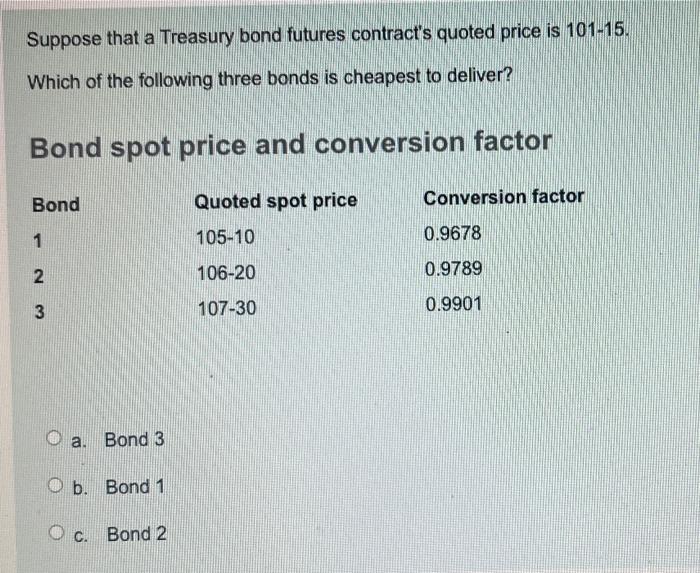

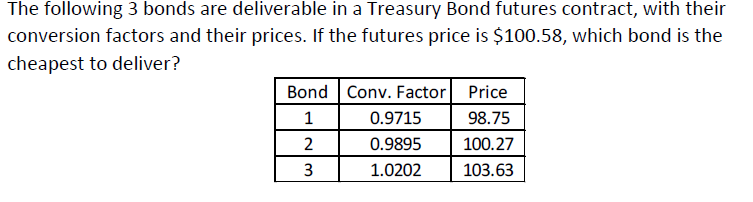

P1.T3.720. US Treasury bonds: conversion factors, cheapest-to-deliver & theoretical futures price | Forum | Bionic Turtle

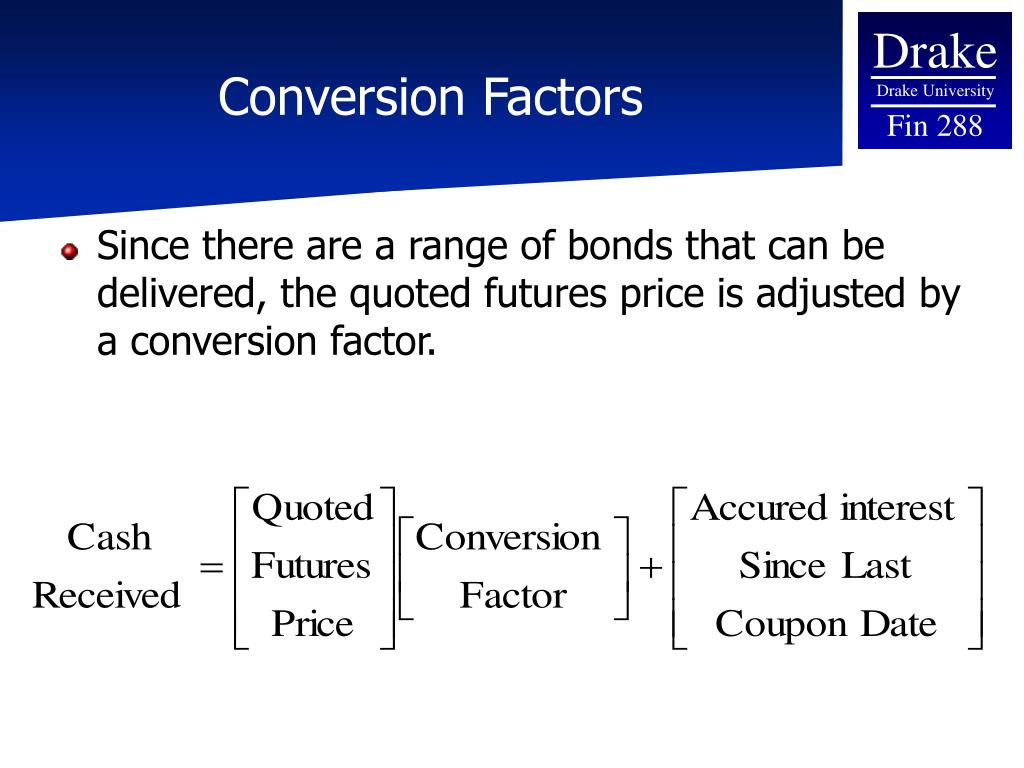

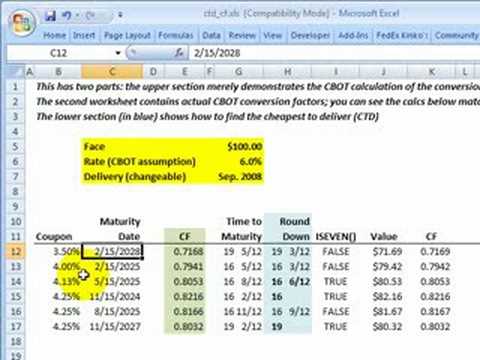

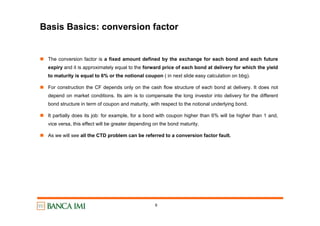

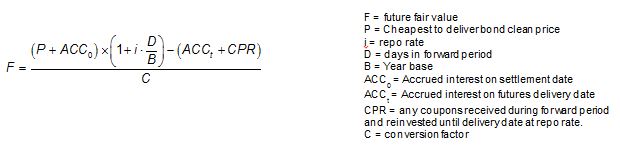

Lecture 11. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download